Why More Traders Are Using Demo Accounts on Delta Exchange Before Going All In

India’s enthusiasm for crypto trading has soared following the COVID-19 pandemic, and by 2024, the country reached over 90 million users – establishing itself as the world’s top market for crypto adoption. A significant portion of these traders are now gravitating towards crypto derivatives, eager to move beyond basic spot trading and experiment with more versatile strategies.

More traders are using demo accounts on Delta Exchange to confidently test strategies, manage risk, and build skills before investing real funds.

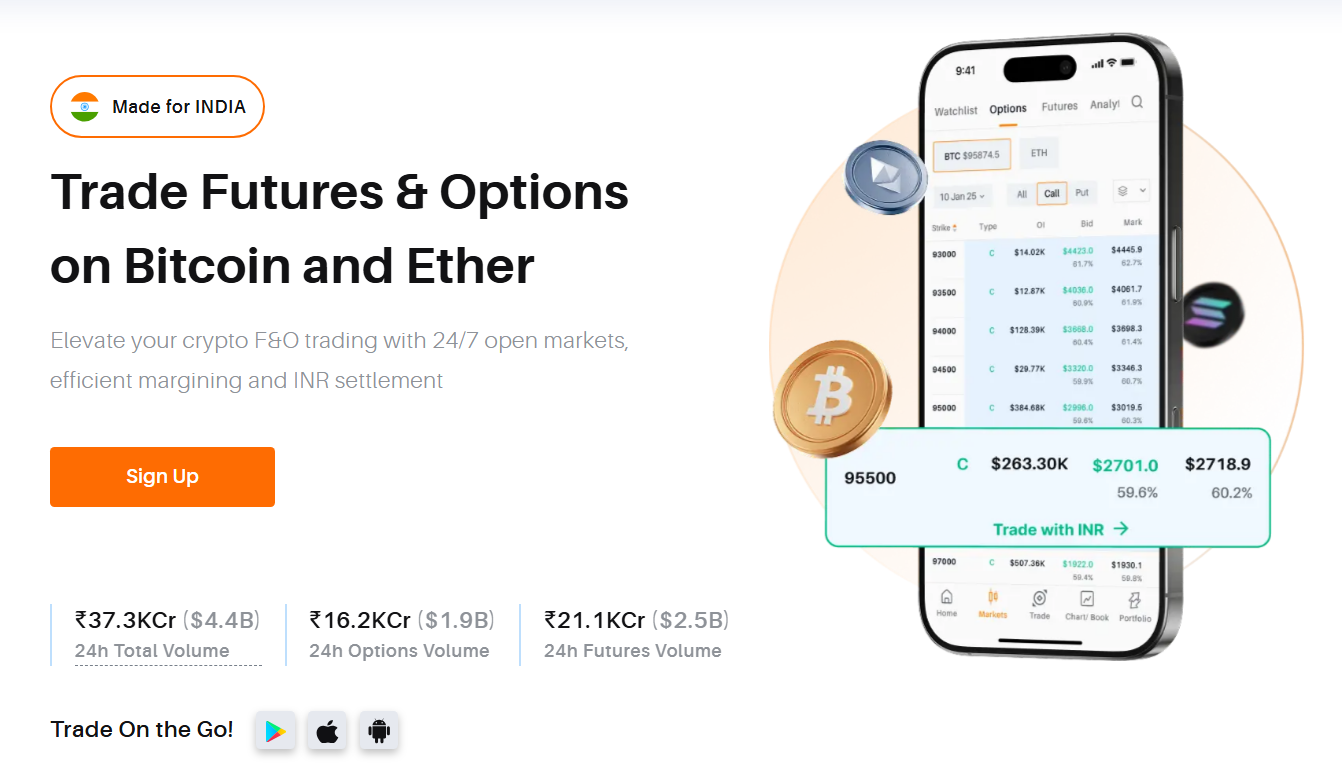

Getting to Know Delta Exchange

Delta Exchange: One of the top platforms for crypto derivatives trading

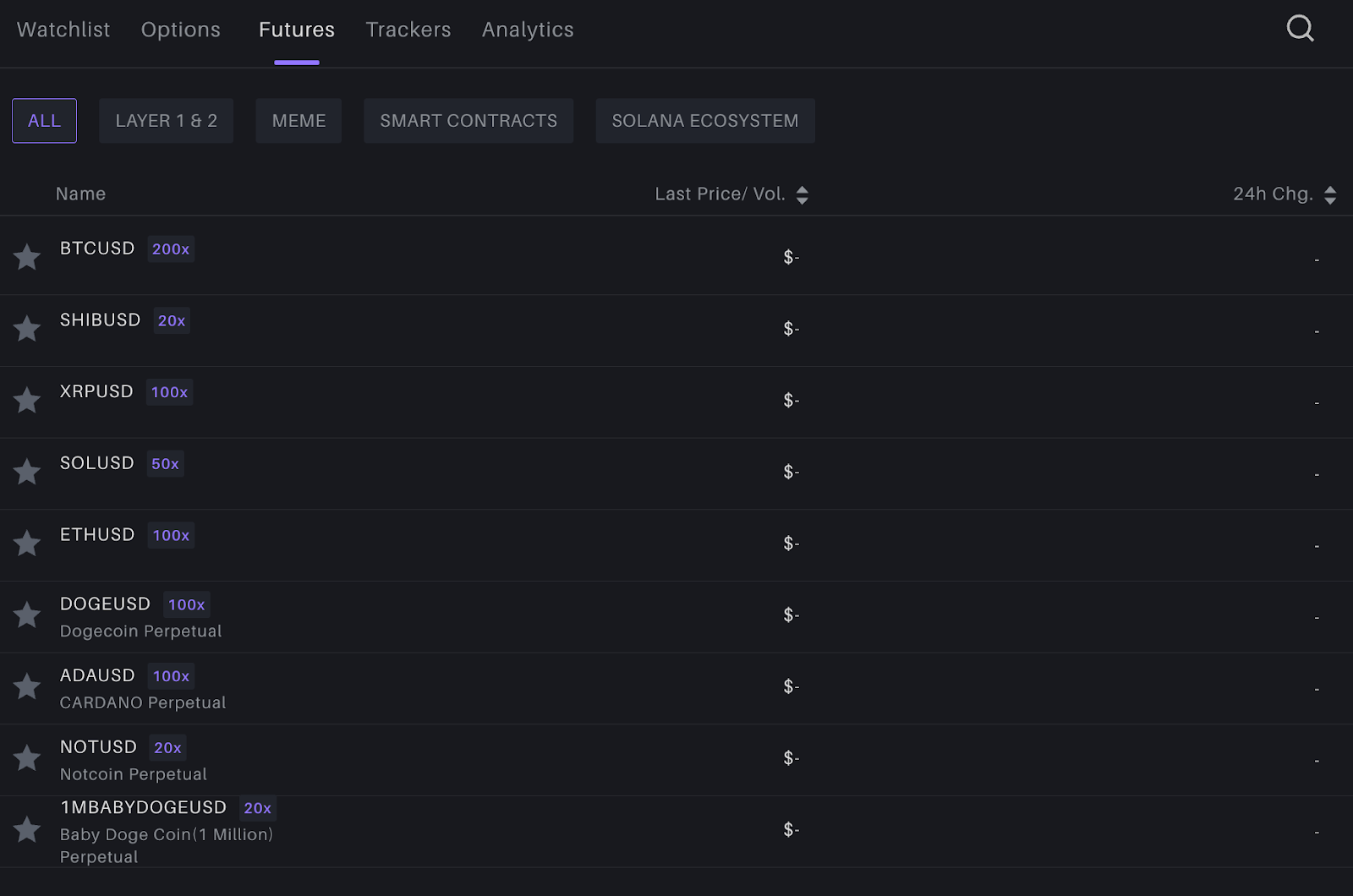

Delta Exchange launched in 2018 with the goal of making crypto derivatives trading straightforward and accessible to all trader profiles. Since then, it has become a highly trusted cryptocurrency exchange, providing an extensive selection of futures and options for BTC and a variety of altcoins.

The platform follows FIU-India regulations, putting safety first and delivering peace of mind to users with every transaction. Thanks to its large Indian user base, traders can transact directly in INR without dealing with currency conversion, while advanced trading tools and deep liquidity ensure strategies are executed smoothly – which is why the daily volume has hit $4.4 billion this year.

On top of this, the Delta Exchange mobile crypto trading app, for both iOS and Android, simplifies trading, letting users buy and sell BTC and other altcoins easily, anytime, and from any location.

Why Demo Accounts Are Surging

Demo accounts provide a no-risk environment, letting traders simulate crypto derivatives strategies using virtual money under real market conditions.

- Traders can practice futures and options orders, experiment with leverage, and experience price volatility risk-free.

- Virtual funds mirror the trading reality, so decisions feel authentic, but mistakes don’t cost real money.

- Both beginners and seasoned investors benefit from skill-building and testing without financial exposure.

Advantages of Delta’s Demo Account

Delta Exchange sees increased demo account use due to its INR-first approach, intuitive design, and robust derivatives suite.

- Traders avoid USD conversion hassles, gaining direct INR support for both demo and live accounts.

- The user interface replicates live trading, from advanced charting tools to basket orders, so learning on demo smoothly transfers to real trades.

- Orders executed in demo mode follow the same order book dynamics found in live markets.

- Live bid/ask spreads and technical indicators function identically in both modes, building trader confidence.

Benefits for All Types of Traders

Newcomers and experienced market participants both maximize the demo feature for various goals.

- First-timers get comfortable with complex derivatives – like European-style options and futures – without risking their own funds.

- Advanced traders use demo mode to backtest strategies and simulate multi-leg options positions before committing capital.

- Institutions and those who prefer algo trading often run automated strategies in demo to monitor potential performance and platform executions.

Why Traders Prefer Practice – Before Going All In

The surge in demo account usage reflects a change in trading culture: building real skills before risking capital.

- Crypto derivatives are complex and volatile; demo accounts let users calibrate strategies, set risk parameters, and monitor trades safely.

- INR-based demo accounts resonate with Indian traders, bypassing currency conversion and market unfamiliarity.

Steps to Access the Demo Trading Mode

Delta Exchange’s demo account

Follow these simple steps to try the demo trading mode on Delta Exchange:

- Head over to the Delta Exchange website.

- Register for free or log into your Delta Exchange account if you already have one.

- Once logged in, find the ‘More’ or ‘Profile’ tab and choose the Demo Trading option. On some platform versions, this may appear directly on the trading interface.

- Pick the crypto derivatives you want to explore – from Bitcoin (BTC) and Ethereum (ETH) to various altcoins. Demo trading includes futures, perpetual contracts, and options.

- Execute trades using virtual funds and all the same features found in the live platform. You can place market or limit orders, set trailing stops, or combine options trades using the strategy builder.

- Keep track of your open positions, unrealized profit and loss, order history, and key performance details just like you would when trading live.

- Analyze the outcome of your strategies – check if your stop-losses were triggered and whether your position sizing worked well. Use these insights to sharpen your trading skills.

Tips to Optimize Demo Trading Experience

Making the most of demo mode means using these practical habits:

- Maintain a trade journal, analyzing both successful and failed trades for better learning.

- Begin with small virtual positions, simulating realistic constraints and gradual scaling.

- Test strategies across different volatility phases to prepare for sudden market shifts.

- Treat virtual trades like real ones, enforcing discipline and consistency.

Why Delta Exchange’s Demo Account Stands Out

Delta Exchange distinguishes itself with a deep focus on accessibility, especially for INR-based users.

- The demo account directly supports local currency and familiar tools, helping users move seamlessly to live trading when ready.

- High liquidity, robust order management, and a feature-packed app all mean traders are well-prepared after demo practice.

- Automated trading bots and basket order tools in demo mode enhance learning and execution for strategy-focused traders.

To Sum Up

More traders are using demo accounts on Delta Exchange as a sandbox for strategic growth, confidence building, and market education. Whether exploring new derivatives, fine-tuning options positions, or simply learning the trading platform, demo trading remains the smart first step before real capital commitment, ensuring every trader can level up without risk.

Delta Exchange’s intuitive, INR-based demo accounts stand out for beginners and pros alike, providing a safe, authentic training ground to prepare for the real world of crypto derivatives trading.

Ready to start risk-free trading? Try out Delta Exchange’s demo account today.

Disclaimer: Cryptocurrency trading involves a high degree of risk and may not be suitable for all investors. Prices are very volatile and subject to market risks. Readers are advised to carry out their own research and consult licensed financial advisors before making any investment decisions. Delta Exchange operates in compliance with applicable Indian regulations and is registered with the Financial Intelligence Unit (FIU) of India.

Frequently Asked Questions

Is registration required for demo trading?

Users must sign up or log in to access the demo trading section.

Does the demo account offer technical analysis tools?

Built-in charting, indicators, and strategy builders are included to support robust analysis.

Can I trade in INR on demo accounts?

Yes, Delta Exchange’s demo accounts support INR trades, matching live trading conditions.